El Informe de Impacto en el Consumidor del ITRC de 2025: Una nueva era del crimen de identidad

Cómo los delitos de identidad en constante evolución están afectando las finanzas, el bienestar y la seguridad digital de los estadounidenses

Conclusiones

- Comprender qué es el Centro de Recursos para el Robo de Identidad (ITRC) y por qué su trabajo es importante.

- Descubra cómo está evolucionando el delito de suplantación de identidad, con un creciente impacto financiero y emocional.

- Descubra por qué los ataques repetidos y la usurpación de cuentas en redes sociales están en aumento.

- Vea cómo las víctimas de alto riesgo enfrentan delitos más complejos y costosos

- Explore el creciente papel de la inteligencia artificial (IA) en el robo de identidad y lo que significa para los consumidores.

¿Qué es el Centro de Recursos para el Robo de Identidad (ITRC)?

Fundado en 1999, el Centro de Recursos para el Robo de Identidad (ITRC, por sus siglas en inglés) es una organización nacional sin fines de lucro dedicada a empoderar y guiar a consumidores, víctimas, empresas y agencias gubernamentales para minimizar el riesgo y mitigar el impacto del compromiso y el delito de identidad.

El ITRC ofrece asistencia gratuita a las víctimas y educación al consumidor a través de su sitio web, chat en vivo y soporte telefónico gratuito. También rastrea brechas de datos y ofrece recursos tanto para individuos como para empresas con el fin de mantenerse informados y protegidos, incluyendo un informe anual sobre las tendencias del año anterior en robo de identidad y brechas de datos. El Informe de Impacto en el Consumidor del ITRC 2025 se publicó recientemente, y su tono es marcadamente más urgente que los informes de años anteriores.

Obtenga más información sobre la misión y los servicios del ITRC en IDTheftCenter.org.

Los impactos financieros y emocionales están aumentando.

El Informe de Impacto del Consumidor de 2025 revela una realidad preocupante: el daño infligido a las víctimas de delitos de identidad ha alcanzado niveles de crisis. Los criminales están monetizando las identidades robadas a tasas más altas, con más víctimas sufriendo pérdidas financieras significativas. De hecho, más del 20% de las víctimas que contactaron con el ITRC reportaron pérdidas superiores a $100,000, y más del 10% perdió al menos $1 millón.

Pero el daño no es solo financiero. El trauma emocional es omnipresente, con el 83% de las víctimas sintiéndose preocupadas o ansiosas, y el 78% sintiéndose violadas. Resulta alarmante que el 67,8 % de las víctimas de la población general hayan declarado haber considerado autolesionarse como consecuencia de sus experiencias, una cifra que pone de relieve la urgente necesidad de apoyo e intervención.

Ataques repetidos: Una amenaza en aumento

El informe muestra que los criminales están apuntando cada vez más a las víctimas anteriores en múltiples ocasiones. Entre las víctimas de la población general en 2025, el 31.5% informó haber sido victimizado dos veces y el 24.6% tres veces en el último año, ambos aumentos significativos respecto a 2024. Esta tendencia subraya la importancia de la vigilancia continua y las medidas de seguridad sólidas.

La Comisión Federal de Comercio de EE. UU. ofrece esta lista de consejos prácticos para protegerse y recuperarse tras un incidente de robo de identidad.

Usurpación de cuentas de redes sociales: La principal amenaza

Para el público en general, la usurpación de cuentas en redes sociales se ha convertido en la forma más comúnmente reportada de uso indebido de identidad, con un 35% de víctimas afectadas en 2025. Estas usurpaciones pueden llevar a la pérdida de ingresos, oportunidades laborales e incluso vivienda, ya que los criminales utilizan cuentas comprometidas para estafas y suplantación.

La agencia de informes de crédito Equifax ofrece esta lista de medidas para ayudar a prevenir el robo de identidad en las redes sociales.

Las víctimas de alto riesgo se enfrentan a delitos financieros más complejos.

El informe también destaca que las víctimas que con frecuencia buscan asistencia especializada son predominantemente blanco de delitos más complejos y orientados financieramente, como solicitudes fraudulentas de préstamos o tarjetas de crédito. Es más probable que sus casos permanezcan sin resolver durante meses o incluso años, y a menudo requieren intervención experta para navegar por las secuelas burocráticas.

Para conocer los pasos que puede seguir después de descubrir que ha sido víctima de un fraude financiero, consulte este artículo de la Commodity Futures Trading Commission.

IA: El nuevo campo de batalla para la seguridad de identidad

La preocupación por inteligencia artificial (IA) es alta entre las víctimas, según el informe de ITRC. Más de dos tercios ven la IA como un campo de batalla principal para la seguridad de la identidad en el futuro. Aunque los consumidores en general son más propensos a atribuir su victimización a la IA (correctamente o no), ambos grupos coinciden en que las amenazas futuras serán moldeadas por los avances tecnológicos. Existe un consenso en que proteger a los consumidores del fraude impulsado por IA requiere un enfoque colaborativo que involucre a empresas tecnológicas, gobiernos e individuos.

Este anuncio de servicio público del Buró Federal de Investigaciones de EE. UU. destaca las formas en que la IA está ayudando a impulsar un aumento en el robo de identidad.

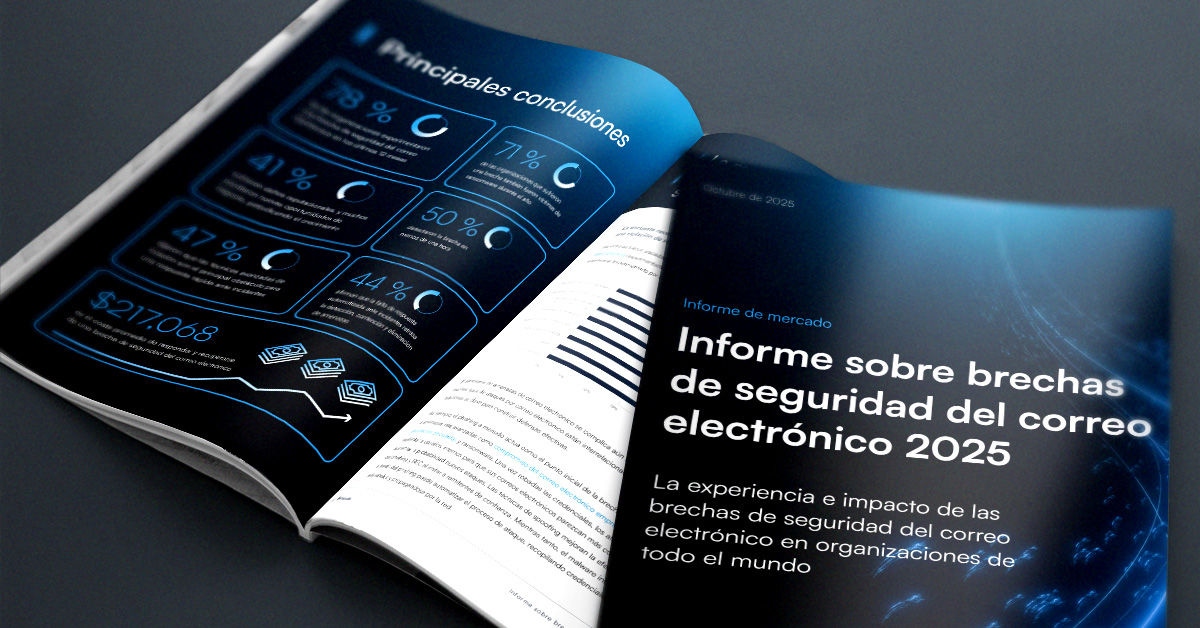

Informe sobre brechas de seguridad del correo electrónico 2025

Principales hallazgos sobre la experiencia y el impacto de las brechas de seguridad del correo electrónico en organizaciones de todo el mundo

Suscríbase al blog de Barracuda.

Regístrese para recibir Threat Spotlight, comentarios de la industria y más.

Informe sobre perspectivas de clientes MSP 2025

Una perspectiva global sobre lo que las organizaciones necesitan y desean de sus proveedores de servicios gestionados de ciberseguridad.